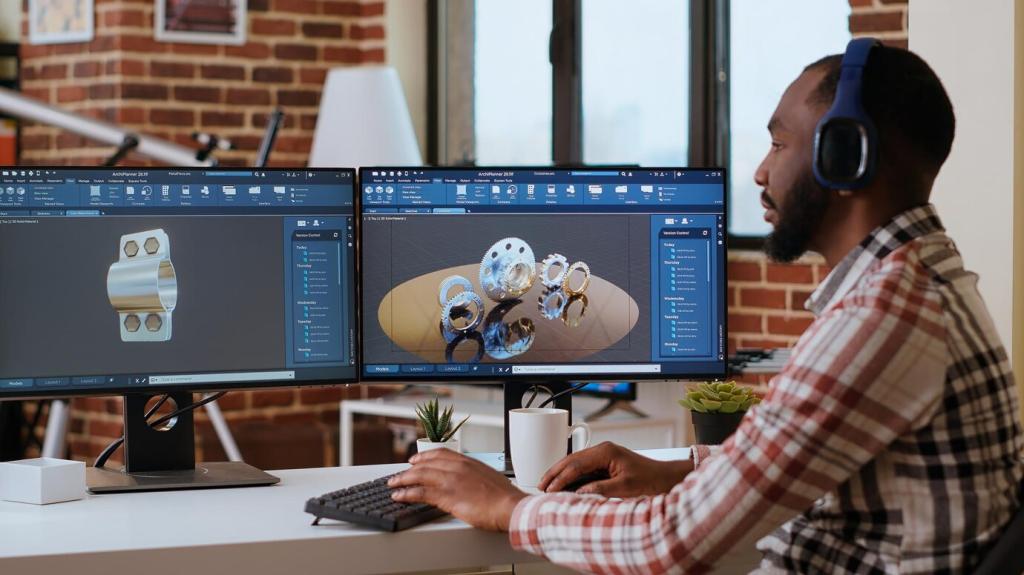

Enhancing User Experience through Digital Tools in Fintech

Understanding the Fintech UX Landscape

01

Great fintech UX trims cognitive load at every step: clear account states, single-tap cards, humane error recovery, and invisible limits that explain themselves. When flows feel like conversation instead of interrogation, users return. Which step in your product feels heavy today? Reply, and let’s lighten it.

02

Trust grows when security feels helpful, not hostile. Risk-based authentication, biometric confirmations, and plain-language consent create confidence without creating walls. Every alert should answer why it matters. If your alerts spark anxiety instead of assurance, send us a screenshot, and we’ll suggest calmer microcopy.

03

When Maya tried splitting a dinner bill abroad on a shaky signal, her app pre-fetched balances, offered offline QR, and queued the transfer. That tiny grace turned stress into relief. Share your own everyday UX win or fail; we’ll analyze the pattern behind the moment.

Smart KYC and Guidance

Document scanning with live feedback, NFC passport reads, and address pre-fill slash errors and time. Real-time hints beat post-submit scolding. Show users what is acceptable before they fail, and explain why it matters. What percentage of your KYC failures is preventable? Tell us; we’ll benchmark it.

Progressive Disclosure, Not Paperwork

Ask only what you need, when you need it. A visible progress bar, saved state, and return links reduce abandonment. Bundle explanations into friendly tooltips, not dense walls of text. If one form field scares people, share it with us, and we will suggest a kinder variant.

A First-Week Journey That Builds Confidence

Omar opened an account to send money home. Day one verified identity; day two explained transfer limits; day three offered a fee-free trial. He felt guided, not sold to. What does your first week teach? Tell us, and we will map a gentler learning arc.

Personalization Powered by Data

Event-driven nudges work when they are timely, specific, and kind. After two consecutive late bill payments, a reminder that includes payday alignment options helps more than scolding. Make the smallest next step obvious. What habit are your users struggling with? Reply, and we will propose one nudge.

Personalization Powered by Data

Surface what matters in the moment. Traveling? Prioritize card controls, exchange rates, and travel notices. Late night? Reduce visual noise, offer dark mode, and delay non-urgent prompts. Context avoids choice overload. Tell us one context your app sees, and we will sketch a smarter default state.

Show fees before action, confirm them after, and explain how to avoid them next time. Visualize total cost across time, not just per transaction. When users know the rules, they feel respected. Send your most confusing fee flow, and we will workshop a clearer version.

Accessibility and Inclusivity in Fintech

Design for Thumbs, Eyes, and Ears

Large tap targets, sufficient contrast, and screen reader labels are fundamentals. Voice-friendly actions and concise headings help cognitive load. Accessibility is good business, not charity. What assistive technology do your users rely on? Name it, and we will outline a test you can run tomorrow.

Feedback That Teaches, Not Teases

Instead of vague success states, explain what changed and what to do next. A transfer confirmation that shows timelines, reversal options, and contact links removes doubt. Teaching reduces support. What success screen gets questions anyway? Post it, and we will propose a clearer variant.

Meaningful Motion and Haptics

Motion should signal state changes and reduce scanning, not distract. Subtle haptics on risky actions, elastic easing on card swipes, and progress pulses during transfers create calm. If animation ever stalls comprehension, tell us where, and we will tune the tempo and hierarchy.