Key Technologies Driving Fintech Evolution

Behavioral fraud detection at scale

By modeling device fingerprints, typing cadence, geolocation drift, and transaction context, modern systems flag anomalies within milliseconds. One European neobank cut card-not-present fraud by 38% after shifting from rules to streaming ML. Have you piloted behavioral features beyond velocity checks? Share your learnings below.

Credit scoring beyond traditional data

Alternative signals—cash-flow histories, invoice performance, and platform sales—unlock fairer credit for thin-file borrowers. A craft seller with seasonal revenue secured working capital when cash-flow analytics outperformed a legacy score. If your team rebalanced models during volatility, tell us what features proved unexpectedly predictive.

Personalized financial coaching at scale

AI-driven nudges transform generic alerts into timely guidance: automate savings the day after payroll, renegotiate a subscription, or restructure a high-APR balance. One app reported a 21% boost in user retention after adding contextual goals. Want a deep dive on responsible AI guardrails? Subscribe for our upcoming explainer.

Open Banking APIs and Embedded Finance

Consent-driven data sharing

With standardized scopes, fine-grained consent dashboards, and reliable token refresh, users finally control who sees what and for how long. A budgeting app reduced churn after making permissions transparent and revocable. Which consent patterns improved trust for you—granular categories, time-limited access, or real-time revocation?

Payments inside everyday experiences

From ride-hailing to marketplace checkouts, embedded rails eliminate redirects and failed handoffs. A small tea shop boosted repeat orders after enabling one-tap account-to-account payments within its app. If you optimized conversion, was it network tokenization, fewer steps, or better error messaging? Share your data-backed story.

SMB financing via platform data

Platforms underwriting merchants with live sales and returns data can fund quickly and fairly. A restaurant secured capital based on weekend spikes, not stale statements. Want a breakdown of risk-adjusted pricing using cohort behavior and seasonality? Subscribe for our practical guide with sample feature sets.

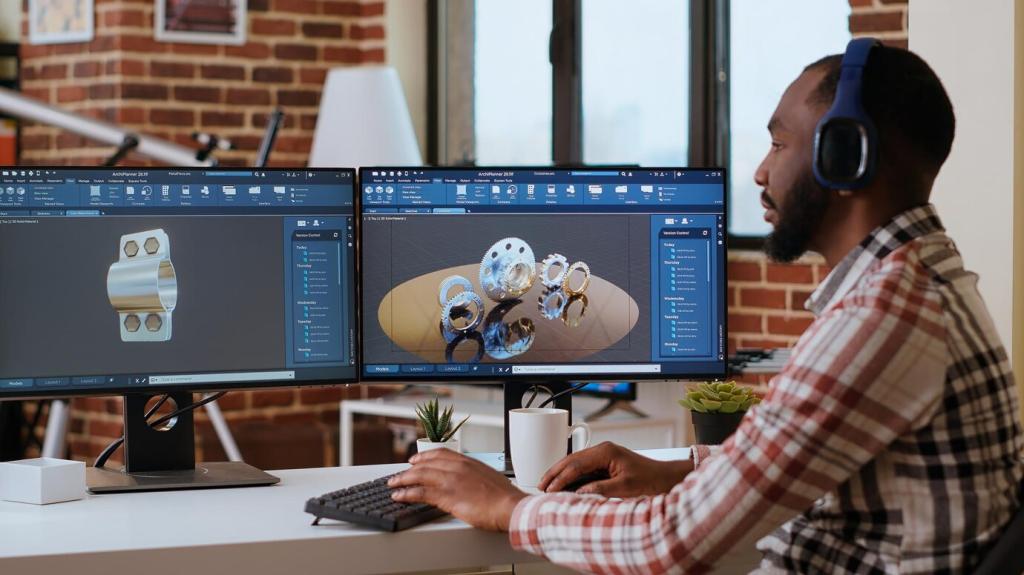

Cloud-Native Architecture and Microservices

Trading surges and holiday shopping no longer require overprovisioned monoliths. One broker migrated to Kubernetes with horizontal autoscaling, cutting latency during a market spike by 42%. What metrics guided your scaling policies—P95 latency, queue depth, or saturation? Comment with your favorite early-warning signal.

Cloud-Native Architecture and Microservices

Circuit breakers, idempotency, and bulkheads isolate failures before customers notice. A payment provider discovered a hidden dependency via chaos drills, then reworked retries to avoid duplicate charges. Interested in our resilience checklist with test scenarios? Ask and we will include it in the next edition.

Digital Identity, Biometrics, and Zero-Trust Security

WebAuthn and device biometrics remove memorized secrets from the loop. A lender saw sign-in success rates climb while support tickets fell sharply. How did you roll out recovery without reintroducing weak factors? Share your blueprint so others avoid the same edge cases and account takeover pitfalls.

Digital Identity, Biometrics, and Zero-Trust Security

Session risk evolves, so authentication should too. Device posture, IP reputation, and behavior models adapt step-up prompts in real time. One bank halved false declines using adaptive challenges. Want our matrix mapping risk bands to actions? Comment, and we will publish the full reference next week.